What is Margin Statement?

Meaning-

The statement informs the client about the utilisation of the available margin. It gives an idea of the free margin available in the account to take new positions without incurring a penalty. The daily margin statement is prepared in a definite format prescribed by the Securities and Exchange Board of India.

How to read it?

The daily margin statement offers a comprehensive view of the margin status including the amount deposited towards margin, amount utilized, etc.

This is a password protected statement and you can access it by entering your PAN as the password. Further, every trade has a margin requirement. So, if you trade on multiple exchanges, then the portal will send you a combined daily margin statement.

What is daily Margin Statement?

A daily margin statement is a report that provides clients with information regarding their margins. It includes information on deposited margins, such as fund transfers and pledged collateral, as well as blocked margins for held or taken positions. The report aims to inform clients of the following:

- Margin required by the exchanges for the positions taken or held.

- Availability of free margins in the account to take new positions.

- Margin shortfall in the account so that the clients can maintain adequate funds to avoid any margin penalty.

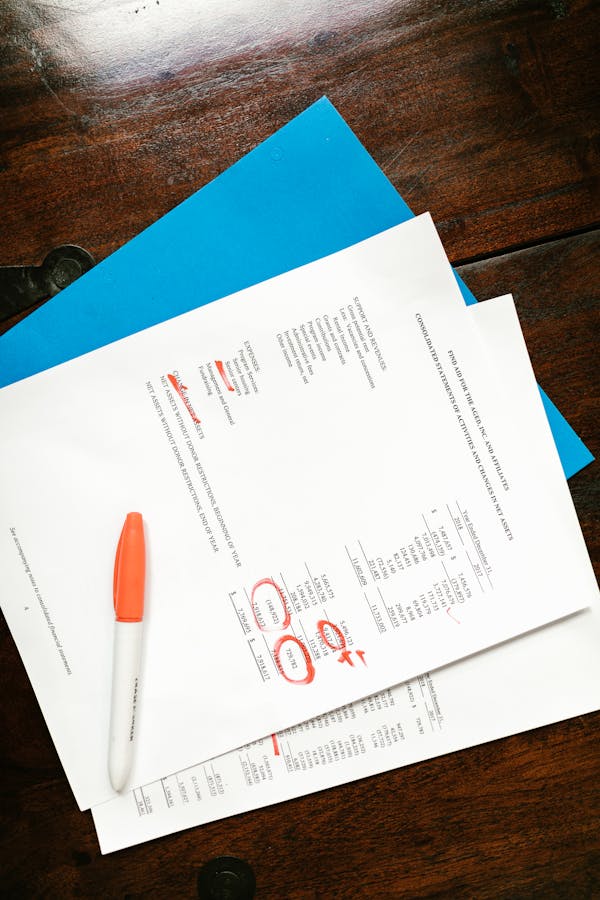

Different Component of Margin Statement:

1. Margin Available

The Margin Available section provides details of cash balance, margin received from pledging shares (collateral margin) and value of shares sold from the demat account, which can be considered towards the margin, also referred to as Early Payin(EPI) margin

2. Margin Required

The Margin required section indicates the exchange mandated margins to initiate the trades in respective segments.

Here’s a detailed explanation of the five columns in this section:

Upfront Margin required : This column shows the upfront margins. Upfront margin is the minimum amount required to take a trade and is to be collected on an upfront basis on trade day. Upfront margins for each segment are as follows:

EQ = Minimum margin + Additional margin

F&O = Span Margin + Extreme Loss Margin

CDS = Span Margin + Extreme Loss Margin

3. Margin Collected

The total Margin Available is distributed across the various heads of Margin Required value, prioritising the upfront value.

Here’s a detailed explanation of the seven columns in this section:

- Upfront margin collected : This column shows the upfront margin collected against the Upfront Margin required from the available margin of the client.

- Consolidated crystallised obligation collected : This column shows the consolidated crystallised obligation collected against the Consolidated Crystallised Obligation required from the available margin of the client after allocating the funds towards the upfront margin.

- Delivery margin collected : This column shows the delivery margin collected against the Delivery Margin required from the available margin of the client after allocating the funds towards the upfront margin and consolidated crystallised obligation.

- Total End of the day (EOD) Margin collected : This column shows the sum of the Upfront margin , Consolidated Crystallised Obligation, and Delivery Margin collected .

- End of the day (EOD) Excess/ Shortfall : This column shows the difference between the total margin available and the Total EOD margin required . A negative value indicates margin shortfall.

- Total Peak margin collected : This column shows the peak margin collected against the Peak Margin required from the available balance of the client.

- Peak Excess/Shortfall : This column shows the difference between the Total Peak Margin available and the Total Peak margin required . A negative value indicates margin shortfall.

MCX = Span Margin

Thank you for reading hope you will love to follow us!

Comments

Post a Comment