RBI strengthens regulations for financial institutions participating in Alternative Investment Funds (AIFs).

RBI strengthens regulations for financial institutions participating in Alternative Investment Funds (AIFs).

In a move to prevent the practice of extending additional funds to stressed loans, known as evergreening, the Reserve Bank of India (RBI) issued a directive on Tuesday, instructing banks, non-banking financial companies (NBFCs), and other lenders to refrain from investing in any alternative investment funds (AIFs) schemes with downstream investments in debtor companies.

An AIF is a privately pooled investment vehicle established in India that collects funds from sophisticated investors, whether Indian or foreign, for investment based on a defined policy. While regulated entities regularly invest in AIF units, the RBI expressed concerns about specific transactions that involve the substitution of direct loan exposure with indirect exposure through AIF investments.

The RBI stated that these transactions raise regulatory concerns, as they involve the substitution of direct loan exposure with indirect exposure through investments in AIF units. Evergreening of loans is a temporary fix for a lender trying to revive a loan on the verge of default by extending additional loans to the same borrower.

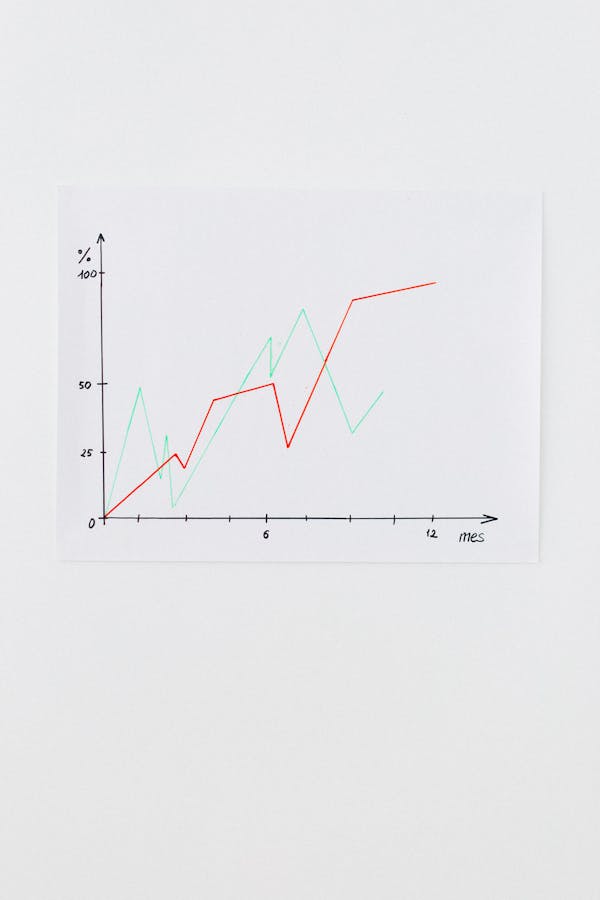

As of December 19, there were 1,220 registered AIFs in India, with a total investment commitment of Rs 8.44 lakh crore as of June 30, 2023, according to SEBI data. In an effort to address concerns related to potential evergreening, the RBI directed regulated entities not to invest in any AIF scheme with downstream investments in a debtor company of the regulated entity.

Downstream investments refer to actual investments by the AIF in a company using funds raised from AIF investors. The RBI clarified that the debtor company of the regulated entity includes any company to which the regulated entity currently has or had a loan or investment exposure in the preceding 12 months.

The RBI emphasized that if an AIF scheme, in which a regulated entity is already an investor, makes a downstream investment in any such debtor company, the regulated entity should liquidate its investment in the scheme within 30 days. Failure to do so will require the regulated entity to make a 100 percent provision on such investments.

The directive aims to prevent the misuse of additional borrowed funds under the AIF route to circumvent guidelines related to loan restructuring and the declaration of non-performing assets (NPAs). Resurgent India's Managing Director, Jyoti Prakash Gadia, noted that the need to make a 100 percent provision on outstanding debt serves as a significant deterrent to irregularities in such transactions.

Disclaimer: This article is pure understanding of Gyaanleikh Team, and we don't allow you rely on the same.

RBI directive on evergreening

Alternative Investment Funds (AIFs) regulations

Stressed loans and evergreening practices

Downstream investments in debtor companies

Reserve Bank of India (RBI) and financial institutions

Evergreening of loans and regulatory concerns

AIF schemes and indirect exposure

Loan exposure substitution in AIF transactions

AIF investment commitment and SEBI data

Registered AIFs in India

Loan restructuring guidelines

Non-performing assets (NPAs) declaration

Regulated entities and AIF investments

Financial regulations for banks and NBFCs

RBI's measures to prevent evergreening

Restructuring of advances in banking

Borrowed funds misuse in AIF route

Liquidation of AIF investments

Investment vehicle regulations in India

Prudential concerns and RBI directives.

Comments

Post a Comment